Why is Direct Lending now vital to get Personal Loans for Bad Credit?

An individual’s financial reliability depends upon their credit score. Based on historical borrowing trends, a credit reference agency evaluates the movement of funds.

It ordains an account with a ‘bad credit score’ when the rating falls below a specified benchmark.

Fund management plays a significant role in the variation of credit ratings. A bad score can turn good when paybacks on borrowings occur on time.

A low credit score can make receiving a loan or credit card challenging and may result in higher interest rates. It can even be difficult to sign up for a cell phone contract.

However, people can avail of personal loans for bad credit from direct lenders if they meet specific criteria attached to the lending.

While personal loans are a prominent option during emergencies, choosing direct lenders can be highly beneficial. They are flexible with their loan terms and provide recommendations after gauging an individual’s situation.

This guide will provide readers with insightful information about personal loans, bad credit and the benefits of approaching direct lenders for a £5000 loan for bad credit.

About Personal Loans

With a personal loan, people can borrow a specific sum they must repay over a predetermined length of time. The period is typically between three and ten years—in monthly instalments.

These loans do not resemble secured loans, like mortgages, fixed to an asset, generally the property itself. That may, thus, also be referred to as unsecured loans.

Repayments

Personal loan repayments can be either fixed or variable. In the fixed rate loan, the interest remains stable for its duration. Whereas in variable rate loans, interest amounts vary, thus, increasing or decreasing the payment.

Individuals can choose to reimburse their loans earlier and in full without attracting penalties. Recompenses can also be put on hold if the borrower has financial difficulties.

Uses

When people need to borrow a sizeable sum of money and would like more time to pay it back, personal loans can be helpful.

The usage varies depending upon the spread of the purchase, which is usually significant like:

- Purchasing a car

- Financing a wedding

- Renovations to a property

- Other large leisure expenses, such as holidays

Personal loans can also balance bad credit. Consumers can consolidate existing debts into a single monthly repayment module.

It makes money management more effortless.

The Bad Credit Loan

Low credit scores could occur due to past financial difficulties or limited credit history. People with poor credit approach financial institutions or direct lenders for personal loans.

Credit issues could include:

- Defaults, Arrears, and CCJs

- Self-employed and part-time workers

- Completed IVA, bankruptcy discharge, or other debt management programmes

- No accounts, no income documentation, and little or no borrowing history

Customers frequently utilise bad credit loans to raise their scores by showcasing successful debt management.

Obtaining a loan for bad credit

Individuals must consider monthly affordability so that the reimbursement fits into their budgets appropriately.

There are different types of loans available, and it would be best for people to choose the ones that fulfil circumstantial needs.

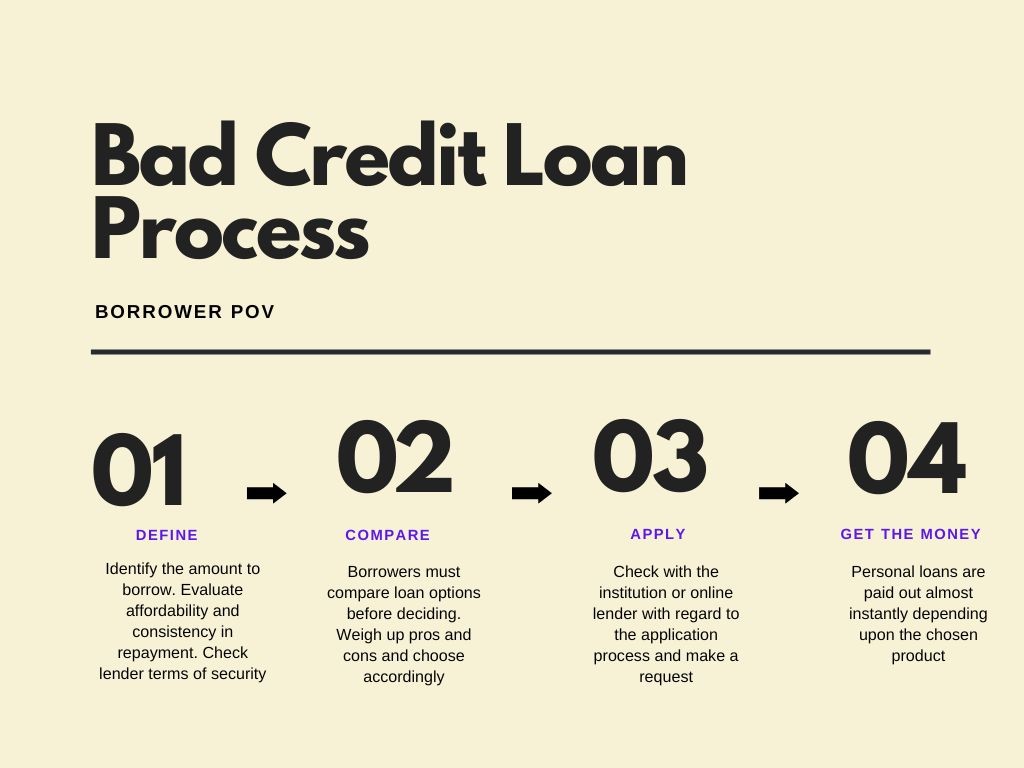

The process begins with consideration or situational awareness, comparison, loan application completion and finally, amount deposit.

The direct lender is the best option for the borrower instead of a large financial institution or bank when it comes to obtaining a loan. Their loans are likely to get rejected due to bad credit.

Direct Lending

Direct lenders surpass the syndicated loan market to offer leveraged loans to borrowers. They gradually developed into market players capable of handling significant committed arrangements.

This type of lending carries significant differences from regulated loans. Therefore, these institutions attract many smaller borrowers who require capital.

Advantages of Direct Lending

Direct lending is one of the most viable alternatives to traditional loan schemes. The funds received by the borrower are held directly by the lender. Here are some advantages to approaching a direct lender:

Easy access to finance

Banks know that lending to individuals with bad credit is risky business. However, direct lenders look at the risk-reward ratio differently. This way, they fill the need gaps successfully and ensure economic turnarounds.

Fast cash release

Direct lenders handle the entire loan procedure by themselves. The loan application is received, considered and approved by them.

This way, borrowers get quicker access to funds, and endorsement processes are short.

With direct lenders operating online, borrowers can now file their applications digitally, thus, considerably speeding up disbursals.

Adaptable and flexible loan terms

Large banks frequently have a single rigid set of terms and conditions. But direct lenders are not constrained by regulations and may be able to modify loan terms to fit consumer needs.

Debtors now have access to a wide choice of interest rates and payback arrangements as more direct lenders enter the market.

Disadvantages of Direct Lending

Just like every coin has two sides, direct lending also comes with risks.

Requires comparison shopping

It takes time to choose the right lender. Individuals must account for research time in their planning process to reap the benefits of approaching a lender directly.

However, people can also request the assistance of a broker who can point them to the right lending company.

Comparing prices might be challenging

There are many different interest rates and loan terms available from direct lenders. It allows borrowers to choose loans that best suit their circumstances.

But it also complicates the process of comparing loans. Here too, individuals can save some time by using a broker.

Regardless, it is vital to shop around for the best price.

Trust is an essential factor

Over many years of operation, traditional lenders have earned the trust of their clients.

Customers are less likely to trust direct lenders who have minimal history. Before accepting a loan offer, it’s critical to take the time to conduct comprehensive research.

Conclusion

While low scores might be inevitable due to various factors obtaining personal loans for bad credit from direct lenders is possible.

Consumers must look for the right direct lending company offering pocket-friendly interest rates. Besides, bad credit repayment eventually reflects on the individual’s credit report.

A good credit score then opens doors to more loan opportunities and growth.

Ailsa Adam is the Editor-in-Chief and former content head at Hugeloanlender. She has been a valuable member of the content strategy team since 2017 due to her abundant experience in the finance sector. Passionate about helping individuals navigate the world of loans and personal finance, she has dedicated herself to acquiring extensive knowledge on various financial products. Before her role at Hugeloanlender,

Ailsa worked as a seasoned journalist and writer, specialising in creating informative blogs and articles on diverse loan types. She is known for her meticulous research and commitment to delivering accurate and engaging content. She holds a degree in MBA Finance and has a keen interest in creative writing and art.