What Are Joint Loans: How Do They Work?

You might be familiar with one sort of joint loan known as a mortgage, which is obtained by two or more persons at the same time. But this is not the maximum amount of money that you and a friend, family member, or partner can use together.

You can also apply for shared overdrafts, auto financing, secured or unsecured personal loans, installment money loans in the UK from a direct lender, and student personal loans.

When you and someone else apply for a loan together, you must both repay it. If one of you can’t or won’t pay it back, the other must. Read on to find out more about joint loans, such as how they work, who can apply together, and if there are any other requirements you may need to meet.

How Do Joint Loans Work?

A joint loan is one utilized and repaid by more than one individual. Most of the time, the agreement will be between two people. This could be a married couple, family members, friends, or business partners. When you acquire a joint loan, you’ll be given the interest rate, how long it will last, and how much you’ll pay back.

If you borrow money from a friend or family member, you might be able to get a bigger loan than if you went to a bank on your own. Lenders often see joint applications as less risky because they don’t have to depend on just one borrower to pay back the loan.

Who is eligible to take out a Joint Loan?

You shouldn’t just take out a loan with a cosigner without giving it some serious thought. This is because whoever gets the loan is responsible for paying it back to the other person.

As a joint borrower, you and the following people might be able to get a loan together:

- A friend

- Partner (there is no requirement that you be married or in a civil partnership)

- Family members (this could be a parent, sibling, or long-lost cousin)

- Partner in business (you may consider taking out a specific business loan)

How do you meet the requirements to get a joint loan?

If you want to qualify for a joint loan, even though the exact requirements will vary from lender to lender, you may have to be able to:

- Reach a certain minimum level of income.

- Both of them live in the United Kingdom.

- Both are adults over the age of 18.

Other conditions that are sometimes needed are living in the same place and having at least one active account with the financial institution in question.

Joint Loan Credit Checks

You will also have to pass the credit checks that the lender will do on you. Every new lender you work with when you take on more loans will look at your credit history. This is to figure out how likely it is that you can pay back the loan.

The likelihood that you’ll get the loan is directly related to how good your credit history is. People with the best credit scores get the biggest loans and the ones with the lowest rates of interest first. This is because these people are thought to be the least likely to miss payments or not pay back the loan.

If two people apply for a loan together, the lender will look at both of their credit scores and request personal information from each of them as both have to pay it back.

This means that a lender will want to know how much each person can pay back. Before applying for a joint loan, it is important to have an open and honest conversation with the person you are considering co-signing the loan with.

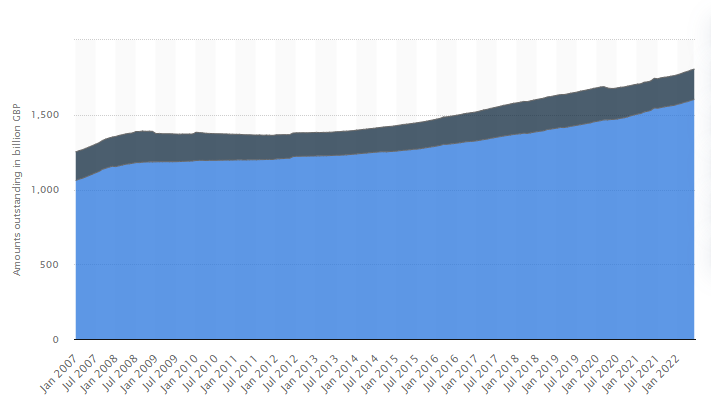

The graph shows the outstanding UK personal loans, excluding student loans (UK):

Source: Statista

How does a Joint Loan affect your Credit Score?

Your credit scores will be linked if you and another individual take out a loan together. If one party has bad credit, this might be an issue. This is because if you try to get credit again on your own, creditors will look at both your past and that of the other person, which may affect their decision.

Pros and Cons Of Joint Loans

A joint loan is a big decision that shouldn’t be taken quickly. Before moving forward, it’s important to think carefully about both the pros and cons.

Pros

- You could receive a bigger loan.

- It’s possible that this is your one and only chance to get the mortgage you need.

- It’s possible that the interest rate will be cheaper than what you’d get on a loan for just one individual.

- You give some of the money needed to pay back the loan.

Cons

- You both must repay the loan.

- Even if one person stops paying back a loan because they don’t agree with the other person, the other person is still responsible for the loan.

- When two people get a personal loan together, it’s possible that one of them will spend the money on something that wasn’t talked about beforehand.

- Even if one dies, the other must repay the full sum.

If you or your cosigner has bad credit, then you can apply for instant 1000 cash loans. You can easily get this type of loan from direct lenders. Also, these might be a good option as these loans come with greater term flexibility and negotiable interest rates.

Can a cosigner help with loan payments?

Since you can’t get out of a joint loan without paying it off, think carefully before getting one. Even if you are no longer together, you may still have to work together to pay back a loan you took out with a former partner. For example, even if you are no longer together, you will still have to pay back a loan you took out with a former partner.

If one of your partners won’t pay their share of the bill, talk to your lender and explain what’s going on. You will be responsible for any payments. Depending on your situation, the lender may provide various methods to pay.

What happens if one borrower dies?

When someone dies, their estate, which is all of the money and property they owned, is often used to pay off any loans they had at the time of their death. If the unpaid debt is part of a joint loan that hasn’t been paid in full, the other borrower is accountable for paying off the remaining balance of the loan.

How to fill out a Joint Loan Application?

When applying for a joint loan, you will probably need to go through these steps, though the exact steps will depend on the lender and the type of loan you want:

- Talk about your different money situations in a way that is both open and honest.

- Choose the amount and length of your loan.

- Choose the best lender for your financial condition by comparing their terms.

- Fill out the necessary forms and make sure to include all of the information and paperwork that the lending institution asks for.

Conclusion

When you borrow money with a partner, there are some risks that come with it because getting a loan is a big financial commitment in and of itself. Before making a choice, it’s important to think about what’s good and bad about the situation. Besides that, you should look into any and all other practical options that might help you reach your goal.

Ailsa Adam is the Editor-in-Chief and former content head at Hugeloanlender. She has been a valuable member of the content strategy team since 2017 due to her abundant experience in the finance sector. Passionate about helping individuals navigate the world of loans and personal finance, she has dedicated herself to acquiring extensive knowledge on various financial products. Before her role at Hugeloanlender,

Ailsa worked as a seasoned journalist and writer, specialising in creating informative blogs and articles on diverse loan types. She is known for her meticulous research and commitment to delivering accurate and engaging content. She holds a degree in MBA Finance and has a keen interest in creative writing and art.