How to Refinance Your Debt despite a Low Credit Score?

Refinancing is when you get a new loan to pay off the older one. It’s a tactic often used to get reduced interest rates, lowering your monthly payments.

It may assist you in better debt management while releasing some cash flow.

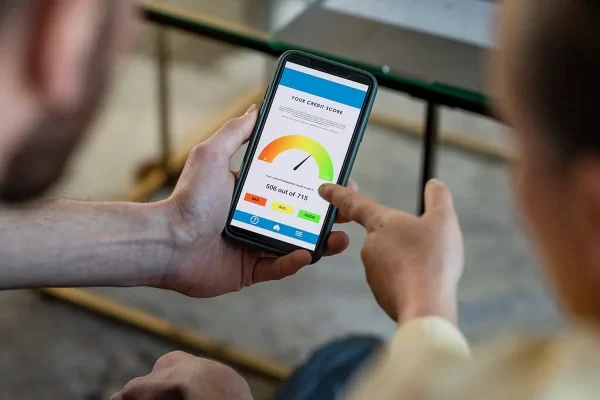

However, refinancing might be challenging if your credit score is poor. Lenders may be reluctant to accept your refinancing application if you have a poor credit score since they see it as a risk.

There may be tighter conditions or higher interest rates.

Despite this, refinancing is still doable, even with a poor credit score. You can overcome the odds if you have patience and the appropriate plan.

Understanding Refinancing and Its Benefits

| Regulatory Change | Impact |

| Enhanced Affordability Checks | Regulatory bodies like the FCA have implemented stricter affordability checks which could make refinancing more challenging for those with low credit scores. |

| Loan-to-Value Cap | Certain caps on Loan-to-Value (LTV) ratios have been introduced, affecting the refinancing options for homeowners with low equity. |

Refinancing involves getting a new loan. Often, the terms are more beneficial in the new loan.

One top advantage of refinancing is a lower interest rate. This means smaller monthly payments and more money for you.

- Refinancing comes with long-term gains too. It can reduce your loan term.

- If you go for a shorter-term loan during refinancing, you might clear your debt sooner.

- Although it can increase your monthly payments, you’ll be free from debt earlier.

Refinancing is also great for debt consolidation. If you have many loans or credit card balances, you can merge them into one refinanced loan. This means you’ll have one payment to make each month. This simplifies your debt management.

Researching Lenders and Loan Options

Traditional approaches may not always be effective for everyone. You may try new ways! These possibilities include getting a loan from a relative or a friend, selling unwanted stuff, or even getting a part-time job.

Refinance offers for low credit scores

People with low credit ratings might utilise loan options like consolidation loans for bad credit. It combines all of their bills into one monthly payment. This kind of loan may be a very useful instrument for handling several bills. Such a loan may be obtained despite having poor credit scores.

Peer-to-Peer Lending

Peer-to-peer lending is another option. This entails borrowing cash from people or organisations ready to lend their resources in exchange for interest payments. It’s a good choice for anyone looking for modest loans. The terms are also more flexible than those of conventional loans.

Crowdfunding

Crowdfunding is another well-liked strategy for raising money. It may be used in a variety of situations, such as starting a company or dealing with a financial emergency. People have been able to finance their projects and take care of their financial necessities.

Credit Unions

Another option is credit unions. They provide a variety of financial services, including loans, and are nonprofit organisations. Credit unions often have softer lending standards than banks and may provide loans to those with bad credit.

Alternative Lenders

There are several lenders available that provide alternatives to traditional bank loans. These lenders often provide loans designed to meet certain requirements, such as loans for 4k pounds. People who may not be eligible for conventional bank loans because of poor credit ratings may want to consider them.

Weighing Your Options

- Weighing your alternatives is essential before making a decision. Recognize each loan’s terms and restrictions.

- Examine the loan conditions, interest rates, and any possible penalties.

- Always keep in mind that the objective is to get funds in a manner that best suits your circumstances.

Always remember that there is a way out of a tight financial situation. Never give up hope, and keep your options open. You are just a few wise choices away from financial independence.

Building a Stronger Financial Profile

Credit Report Review

- Request your free annual credit report from major credit bureaus.

- Examine it carefully for inaccuracies or discrepancies.

- It’s not uncommon to find errors, so if you do, raise disputes promptly.

- A corrected and accurate credit report can accurately represent your financial situation.

- It can also increase your creditworthiness.

Timely Bill Payments

- Paying bills on time is an easy yet significant step towards a stronger financial profile.

- Late or missed payments are damaging to your credit score.

- You can avoid this by setting reminders for each bill’s due date or, even better, automating the payments.

- Consistent, timely payments gradually build up a positive credit history.

- This is beneficial for your credit score.

Remember, building a stronger financial profile does not happen overnight. But, the payoff is worthwhile – a solid financial profile can open doors to more favourable loan terms and financial opportunities. It’s your step towards achieving financial freedom and stability.

Making a Convincing Refinancing Proposal

To begin, get to grips with your finances. Assess your assets, earnings, and current debts. This broad outlook shows lenders that you’re switched on about your financial state.

Forming a Repayment Scheme

The lender’s chief concern is repayment. Lay out a clear repayment strategy. Show them how you’ll meet repayment terms, regardless of your credit.

Highlighting Financial Positivity

Emphasise any new, positive financial habits. Perhaps you’re budgeting well or have stable work now. These facts will enhance your standing and show you’re aiming for fiscal responsibility.

Explaining Your Loan’s Purpose

It’s crucial to justify why you need the loan. Clarity could boost your approval chances, Whether for settling high-interest debts or covering big bills.

Offering Collateral

Discussing collateral comes next. If you can offer security, this could comfort the lender and tilt the balance in your favour.

Adapting to Each Lender

Each lender’s rules vary. Tailor your plan to the lender’s specific needs. In-depth research and understanding are key.

If you follow these, getting approved for loans of big amounts, even with poor credit, is possible. You can easily get 1000 pound loans for people with bad credit or unsecured poor credit loans! With a robust refinancing proposal, you can overcome the odds. The proposal should reflect your financial status and commitment to repayment.

Conclusion

It’s important to maintain financial discipline. You may lower your debt and improve your financial health by using money management skills. It demands self-control, endurance, and the will to break bad behaviours.

Maintaining your spending plan may be difficult, particularly when unforeseen costs arise.

Future planning is an essential part of sound financial management. A sound financial strategy may assure a brighter future and act as a buffer for unforeseen costs.

Always try to improve your knowledge of money management. Keep learning new things. It’s essential to achieving financial stability.If your credit score is poor, try not to become discouraged. Never forget that managing your money is a lifelong process.

Ailsa Adam is the Editor-in-Chief and former content head at Hugeloanlender. She has been a valuable member of the content strategy team since 2017 due to her abundant experience in the finance sector. Passionate about helping individuals navigate the world of loans and personal finance, she has dedicated herself to acquiring extensive knowledge on various financial products. Before her role at Hugeloanlender,

Ailsa worked as a seasoned journalist and writer, specialising in creating informative blogs and articles on diverse loan types. She is known for her meticulous research and commitment to delivering accurate and engaging content. She holds a degree in MBA Finance and has a keen interest in creative writing and art.