7 Reasons Why You Need a Financial Adviser

People often think that only very wealthy people need help with their money. But that’s not the case. Everyone might benefit from making a plan for their money. The long-term well-being of you and your family may be better protected. Therefore you should get objective financial advice from a trained professional.

This advice could help you in a number of ways. For example, by helping you prepare for a more pleasurable retirement, safeguard and develop your assets, or maximise your savings and investments. This blog will discuss why working with a financial consultant is beneficial.

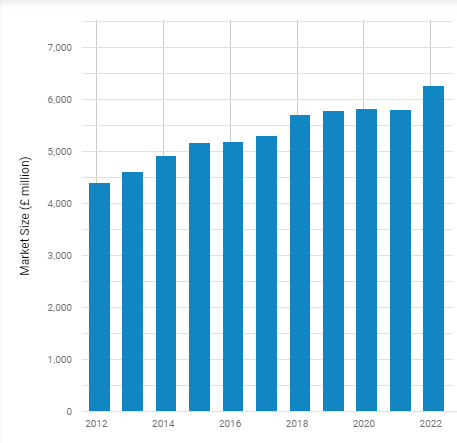

Strong consumer demand for financial advice is expected to boost industry revenue by 3.4% annually through 2022-23. Increasing national savings, disposable family income, and an ageing population have all helped the business. Revenue fell in 2020-21 due to the COVID-19 pandemic. However, this dip was short-lived, and revenue is expected to rise strongly in 2022. Industry sales are predicted to expand by 7.9% in 2022-23, hitting £6.3 billion.

Source: IBISWorld

7 Reasons To Have A Financial Advisor

1. A financial advisor can safeguard your family.

Preparing for how your family will be taken care of if you can’t is the responsible thing to do. But what kind of life insurance plan will help you the most? There are a lot of them, and some of them have what you might call enticing deals to get you to sign up.

An independent financial consultant will take the time to get to know you and your unique situation. They will then be able to offer you the best insurance policy for your needs because they have access to products from the whole market.

2. A financial planner helps to maximise your investments.

Financial planners can help you optimise your assets. This is true whether you already have investments, want to invest extra money or a lump sum you just got, or all of the above.

With the help of professional investment management, you can improve your current financial situation. This could allow you to pay for your children’s college, buy a vacation home, or retire earlier than you had planned.

No matter your goals, a financial adviser can help you determine if they are realistic and devise a plan to reach them. They can give the best advice if you need 5k pound loans in the UK to make investments to maximise your assets or to pay off debts.

3. A financial advisor can help you save and spend smarter.

You must have some long-term ambitions. A financial consultant can help you take the steps you need to grow your assets. So that you not only have a savings account for emergencies but also have extra money for things like vacations and other treats.

The practice of helping you plan your spending and save as much money as possible is part of financial planning. There are often simple things that, when done together, can make a big difference over time.

4. Financial experts can help you plan a comfortable retirement.

It’s in your best interest to start planning for retirement. You should do this if you have specific goals or plans for when you stop working. One of the most popular things a financial consultant does is help people plan for retirement.

Planning for retirement involves more than just asking pension providers for suggestions. An independent financial adviser can help with all parts of reaching retirement goals. Goals like maximising savings and investments, expenditure, and income. All of these are important parts of reaching one’s retirement goals.

5. Financial advisers can help you reach your financial goals.

Many people don’t understand why you would still need a financial consultant if your finances are in order and you have investments. This is because an advisor can help you attain your financial objectives. This is the answer to the question.

Things changed over time. It’s possible that things will get better for you. It’s possible that the economy will go up and down. A financial advisor would say this during hard times to boost you up. Rates of interest could either go up or down.

All of these factors might affect your financial plan. Financial advisers monitor investments and savings objectives. They will evaluate how well they are doing and look for other ways to help you get to where you want to be financial. If there is a situation where you need 10 000 cash loans, an advisor can suggest to you the best option or bank to go with.

6. Financial advisers can help minimise tax liabilities

After investment analysis, consider tax planning. A simple tax summary can save thousands.

Tax planning covers tax-deferred savings, pension, and medical accounts. Transferring assets to a spouse or kid might boost family allowances. You pay less income tax using incentives, growth assets, and CGAs.

Financial conditions have distinct tax laws. Some investments cost more tax. Your adviser knows which assets affect taxes, when they’re due, and how much you’ll owe. A financial counsellor constantly analyses your tax situation.

7. A financial adviser can ease worries.

Why do you think you need to talk to a financial pro? Because, when put together, they make you feel calmer. The world of money is hard, and there are many things to consider when you want to keep your money safe and put it to work for you.

Building a long-term connection with a trustworthy financial adviser can help you attain your goals. You should find that the money you spend on professional advice will pay off in the long run, whether you need general help or more specialized help, such as taking out benefits on money loans today for your usage.

Conclusion

Whether you’re young or elderly, a financial consultant can help you increase and safeguard your wealth. If managing your own money is a pastime you love, you have plenty of time, and you can identify your own biases, you may be pleased doing it yourself. If you’d prefer to do virtually anything else or require particular abilities, a financial adviser can help.

Ailsa Adam is the Editor-in-Chief and former content head at Hugeloanlender. She has been a valuable member of the content strategy team since 2017 due to her abundant experience in the finance sector. Passionate about helping individuals navigate the world of loans and personal finance, she has dedicated herself to acquiring extensive knowledge on various financial products. Before her role at Hugeloanlender,

Ailsa worked as a seasoned journalist and writer, specialising in creating informative blogs and articles on diverse loan types. She is known for her meticulous research and commitment to delivering accurate and engaging content. She holds a degree in MBA Finance and has a keen interest in creative writing and art.